Премахва болката. Блокира възпалението. Намалява отока.

- Революционният продукт при заболявания на периферната нервна система и опорно-двигателния апарат

- Комбиниран троен механизъм на действие

- 8 активни съставки с доказано действие

- Решението при хронична болка и възпаление

- Препоръчван от лекари и фармацевти

- Сигурен ефект само с 1 капсула дневно

За да се движим без болка!

Движенията в човешкия организъм се осигуряват от сложна система от кости, стави, мускули и нерви. Определени състояния, свързани с възрастови изменения, травми или хирургични операции, могат да нарушат този добре смазан механизъм. Доста често, най-страдащи са периферните нерви и ставните хрущяли. Появяват се болки в гърба, кръста и ставите, изтръпване и намалена чувствителност на крайниците, скованост и дискомфорт при движение.

Максофен бързо, ефективно и безопасно възстановява нарушенията в засегната област и възвръща свободното движение и функционалността.

Какви са симптомите, свързани със заболявания на периферната нервна система и опорно-двигателния апарат?

- Болка в засегнатата област (гръб, кръст, стави, понякога по протежение на периферен нерв)

- Изтръпвания на крайниците

- Мравучкане и болезненост

- Намалена чувствителност на ръцете и ходилата

- Скованост

- Намален обем на движение

- Оток и зачервяване

- Нарушена функция

Кога се нуждаем от Максофен?

- Болки в гърба, кръста и ставите

- Дискова херния, дископатия, плексит, радикулит, ишиас, лумбаго, невралгии

- Диабетна и алкохолна полиневропатия

- Други заболявания на периферната нервна система

- Притиснат и възпален нерв

- Чести спортни травми и прекомерни натоварвания

- Хирургични интервенции

- Дегенеративни и възпалителни ставни заболявания (артроза и остеоартрит)

Как действа Максофен?

- Премахва болката в засегнатите области

- Блокира медиаторите на възпалението

- Намалява отока

- Спомага за регенерацията на периферните нерви

- Стимулира собствените сили на организма за възстановяване

- Защитава и подхранва ставния хрущял, ставни връзки и сухожилия

- Възвръща функционалността

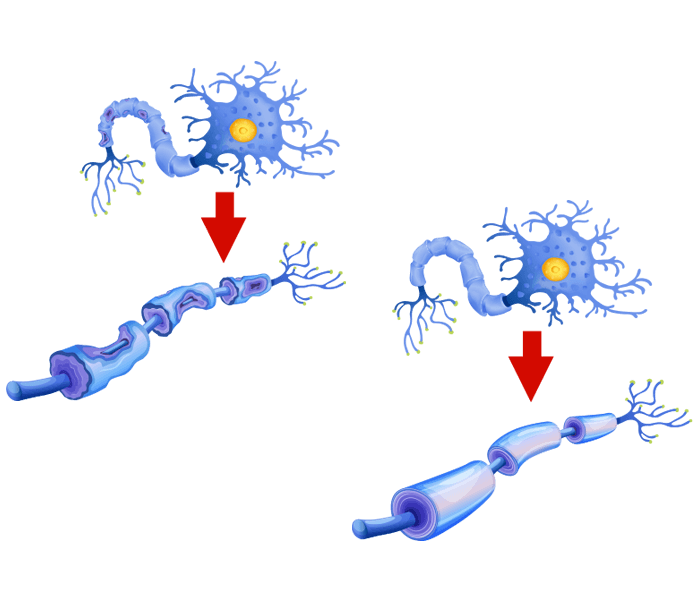

Максофен стимулира изгаждането на миелиновата обвивка и възстановява функцията на периферните нерви

Максофен действа системно върху всички стави, като поддържа свободното движение, без болка и дискомфорт

Какво съдържа Максофен и как действат активните съставки?

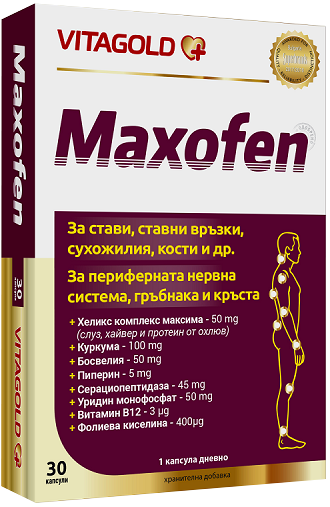

Всяка капсула Максофен съдържа 8 активни съставки със синергичен ефект:

Серазимес – 66mg

Блокира възпалението и намалява болката и отока

Уридинмонофосфат – 50mg

Подпомага нервната регенерация и функционалността на периферните нерви

Хеликс комплекс максима (слуз, хайвер и протеин от охлюви) – 50mg

Подхранва и защитава ставния хрущял, ставни връзки и сухожилия

Екстракт от Босвелия – 50mg

Притежа клинично доказано противовъзпалително и болкоуспокояващо действие

Eкстракт от Куркума – 100mg

Едно от най-мощните противовъзпалителни средства

Пиперин - 5mg

Засилва бионаличността и ефективността на куркумата повече от 20 пъти

Фолиева киселина - 400μg

Спомага за регенерацията на периферните нерви след травми

Витамин B12 - 3μg

Важен за производството на миелин и нормалната нервна проводимост

Защо Максофен е най-добрият продукт срещу болка и възпаление и как точно ни помага?

Болката и възпалението са едни от най-честите симптоми, които карат пациентите да търсят медицинска помощ. Причините за болката могат да бъдат много различни – притискане и възпаление на периферни нерви, дегенеративни промени в ставния хрущял, неправилна поза на работното място, повишено физическо натоварване и други. Във всички случаи е необходимо комплексно повлияване не само на симптомите, а и елиминиране на причините, които водят до тяхната поява.

Благодарение на своята комплексно действаща формула, Максофен едновременно намалява болката и отока, регенерира периферните нерви и подхранва ставния хрущял.

Серациопептидаза

Серациопептидазата е протеолитичен ензим с доказано противовъзпалително, болкоуспокояващо и

противооточно действие. По време на възпаление или травма, в мястото на увредата се наблюдава образуване

на възпалителен ексудат. Серациопептидазата успешно разкъсва коагулиралите съединения на по-къси

фрагменти, подобрява кръвния и лимфен ток, инхибира медиаторите на възпалението, тушира болката и

намалява отока.

Уридинмонофосфат

Редица състояния, като травматизъм, хронично възпаление, дегенеративни процеси, прием на алкохол, могат да

увредят периферните нерви. Увредените периферни нерви имат нужда от уридинмонофосфат, за да ускорят

физиологичните механизми за регенерация. Уридинмонофосфат участва в синтеза на нуклеинови киселини и

изграждането на клетъчните мембрани, като стимулира изграждането на миелин и подобрява нервната

проводимост.

Хеликс комплекс максима (слуз, хайвер и протеин от охлюв)

С напредване на възрастта, както и при прекомерни физически натоварвания, най-много страда ставния

хрущял. Той постепенно губи своята функция да намалява триенето между костите, при което се появява

болка и дискомфорт. Охлювеният екстакт съдържа алантоин – натурална съставка, която подхранва ставния

хрущял, като възвръща еластичността и гъвкавостта на ставните тъкани. В охлювения екстракт се съдържат и

други гликопротеини и глюкозаминогликани, които поддържат здрави ставните връзки и сухожилия.

Екстракт от Босвелия

Биологично активните вещества в екстракта от босвелия блокират ензима 5-липоксигеназа, като намаляват

ставните болки и активират възстановителните процеси. Също така, спомага за подобряване на

кръвооросяването в зоната на ставите, като допринася за доставяне на активните вещества точно в зоната на

увредата.

Екстракт от куркума

Екстрактът от куркума е богат на куркумин, който инхибира освобождаването на медиатори на възпалението

и намалява болката. Куркумата е позната като едно от най-мощните противовъзпалителни вещества.

Пиперин

Пиперинът е естествен алкалоид, който увеличава бионаличността и ефективността на куркумата повече от 20

пъти, с което води до изключително бърз и сигурен ефект.

Фолиева киселина

Фолиевата киселина участва в редица важни процеси в организма. В състава на Максофен, подпомага

регенерацията на аксоните и функционалното възстановяване на периферната нервна система след травми.

Витамин B12

Витамин B12 е необходим за синтеза на миелин. Поддържането на здрава миелинова обвивка на аксона води

до подобряване на сетивността при полиневропатии.

Обективното превъзходство!

- Революционна формула, без аналог

- Комплексно действие срещу болката и възпалението, както и причината за тяхната поява

- Бърз и сигурен ефект

- Препоръчван от водещи невролози, ортопеди, ревматолози и физиотерапевти

- Безопасен дори при продължителен прием

- Удобна опаковка за един месец

- Удобен дневен прием

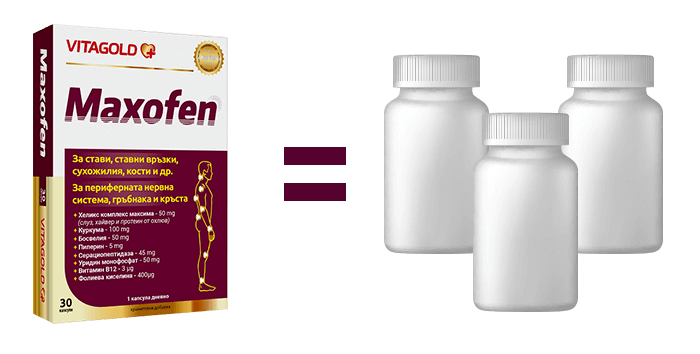

Максофен е 3 пъти по-ефективен от продукти с еднопосочно действие

Как се приема Максофен?

Препоръчва се прием от 1 капсула дневно.

Колко време да приемаме Максофен?

Препоръчва се непрекъснат прием на Максофен от 1 до 3 месеца, в зависимост от тежестта на проблема.

Трябва ли ни рецепта за Максофен?

Максофен може да бъде поръчан онлайн или закупен от най-близката аптека без рецепта.

Последния невролог при когото ходих ми предписа да пия Максофен, но трябва да отбележа, че имаше 1 месечен период, в който пиех Б комплекс.